Defining the process industries

The cluster of industries generally called “the process industries” spans multiple industrial sectors—constituting a substantial part of the entire manufacturing industry—and is generally considered to include petrochemicals and chemicals, food and beverages, mining and metals, mineral and materials, generic pharmaceuticals, pulp and paper, steel and utilities. The following definition from Lager (2017) is used:

The process industries are a part of all manufacturing industries, using raw materials (ingredients) to manufacture non-assembled products in an indirect transformational production process often dependent on time. The material flow in production plants is often of a divergent v-type, and the unit processes are connected in a more or less continuous flow pattern.

Based on this intentional definition, a number of industrial sectors have been selected from all manufacturing industries (Lager, 2010) included in the statistical classification of economic activities in the European community (NACE, 2006). As an extensional definition, the following sectors are recommended for inclusion in the cluster of process industries (NACE codes are introduced in parenthesis):

- Mining & metal industries (05; 06; 07; 24)

- Mineral & material industries (minerals, cement, glass, ceramics) (08; 23)

- Steel industries (24.1; 24.2; 24.3)

- Forest industries (pulp & paper) (17)

- Food & beverage industries (10; 11)

- Chemical & petrochemical industries (chemicals, rubber, coatings, ind. gases) (20; 22)

- Pharmaceutical industries (incl. biotech industries and generic pharmaceuticals) (21)

- Utilities (electricity & gas, water, sewerage, waste collection & recycling) (35; 36; 37; 38).

The process-industrial production environment

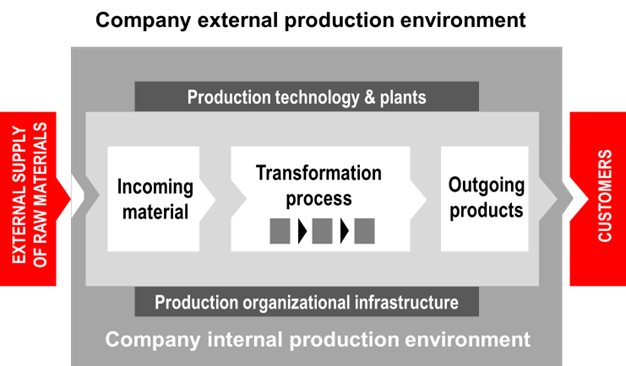

The following simplified structural model of a company’s production system in the process industries illustrates the material transformation system from supplied raw materials into finished products to be marketed to external customers.

A number of general characteristics of companies in the process industries are not directly related to the production system but rather to company overall business models, which could be relevant to consider in innovation. From an RBV perspective, an existing asset-intensive production system and dependencies on captive or raw material from suppliers also distinguish the process industries from other manufacturing industries. Indeed, in some process industry sectors, company creation and expansion have primarily relied on the availability of captive (company-owned) raw materials or well-secured raw material resources.

Because process companies often are very asset-intensive and strongly integrated in one or a few physical locations, their ability to respond to change is often limited in the short term. Furthermore, the ability to create efficient value chains through an interlinkage of production plants, energy flows and infrastructures is second to none in large global operations (e.g., “Verbund” in the BASF company). The equipment in the production process is often a rate-limiting factor, contrary to other manufacturing industries in which the throughput may be limited more by labour. Thus, labour productivity is an important factor in the process industries, but asset productivity is typically far more important.

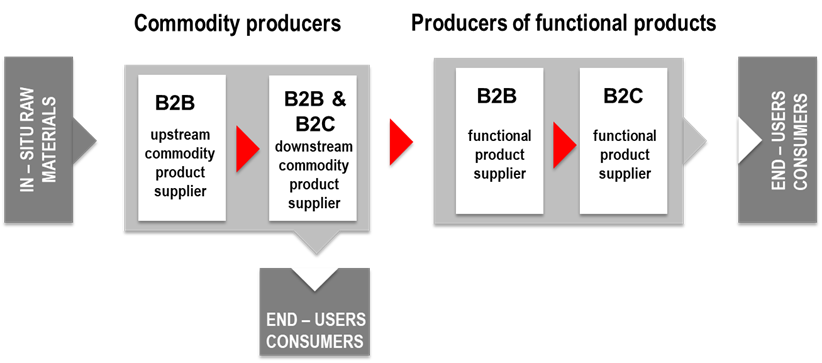

Companies in the process industries can be producers of commodities, functional products or both, but successful product innovation depends to a high degree on an understanding of the chain-like structures of companies. Upstream commodities can be characterized as primary raw material resources often traded on raw material exchanges (e.g., forest products, crude oil, agricultural products, mineral products). Downstream commodities, on the other hand, are products that are processed further (e.g., wood pulp, petrol, metals, construction steel, orange juice). Finally, as shown in the figure below, the supply chain complexity is generally low on the upstream side and high on the downstream side, creating a need for supply chain integration. The overall complexity of the downstream supply chain will influence collaborative development with customers.

Summing-up

The “family” of process industries (or “transformation-based” industries) is here considered as one part of all manufacturing industries, distinguished from the “assembly-based” industries. Moreover, within each sector in the process industries, individual companies may focus on business-to-business customers (B2B), business-to-consumer customers (B2C) or both. Furthermore, some companies transform in-situ raw materials, some operate only in the final stage of a long supply/value chain and, finally, some companies cover the whole chain from in-situ captive raw materials to finished products.

However, it must be recognized that this group of industries is not homogeneous and thus consists of a number of industry sectors with similar characteristics; moreover, not all companies and industry sectors in the process industries share all the process-industrial attributes. One inherent difference between companies in the process industries and other manufacturing industries is that the products supplied to them, and often also delivered from them, are materials or ingredients rather than components. Moreover, the characteristics of incoming materials not only determine the choice of unit operations and the design of the overall production system but also may influence the quality of finished products. Since innovation in the process industries is enabled primarily by process innovation, an in-depth understanding of the production process is vital for successful product innovation. Whereas materials remain the same throughout the manufacturing process in assembly-based industries, in the process industries raw materials undergo an inherent transformational change, becoming an identifiably different material and product. For that reason, manufacturing in the process industries is vulnerable to interruptions, and unplanned stoppages will likely degrade the product quality. The production integration in the process industries in one or only a few physical locations is incentivizing the creation of efficient internal value chains through an interlinkage of production plants, energy flows and infrastructures. Successful management of industrial symbiosis in the process industries must be adapted to the idiosyncratic process-industrial environment in search of advantageous cross-industrial sectoral patterns and opportunities, since emerging industrial convergences also are blurring traditional sectoral boundaries.